What is Reverse Charge Mechanism (RCM) and how is it applicable to you?

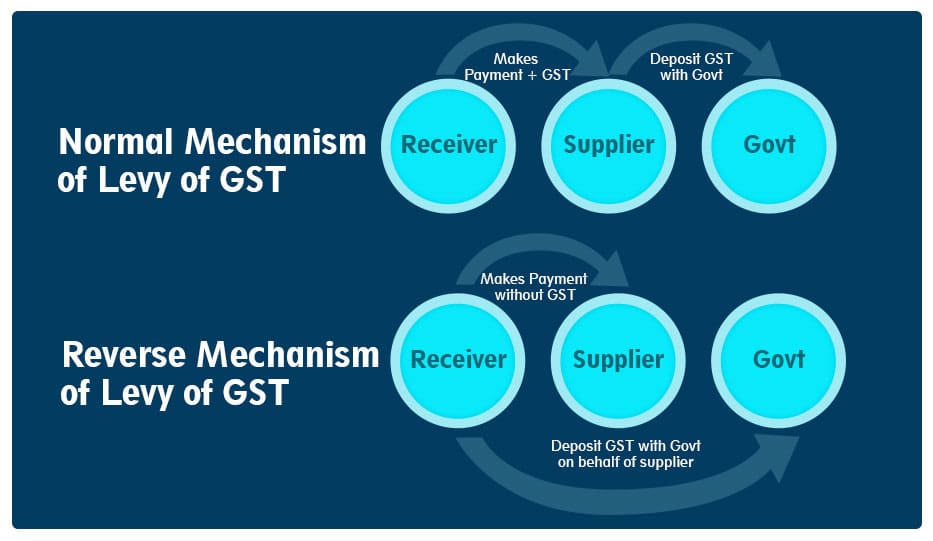

In most transactions, the supplier of goods or services is liable to pay tax to the Government. However, there are certain cases where the tax chargeability rests with the recipient. This mechanism is known as Reverse Charge Mechanism (commonly called as RCM) and is enforced in certain conditions which are explained later in the blog. But first, let us understand what it actually is, and why it was conceived.

About RCM

RCM is not something that took effect after GST was introduced. It was present in previous taxation systems as well. When Service Tax was effective, RCM was applicable for special notified services. Later, when VAT system took over, tax on import duties and transactions with unregistered dealers (provided the receiver / buyer is registered as a taxpayer) became the responsibility of the recipient. After GST came into the picture, reverse charges were crafted to suit the new norms.

The underlying principle of an indirect tax is that the burden of tax has to ultimately be passed to the recipient. Being an indirect tax, this principle holds good for GST. Therefore, under Reverse charge mechanism only the compliance requirements (i.e. to obtain registration, deposit of tax, and filing of returns) has been shifted from the supplier to the recipient. The burden of paying GST ultimately lies on the recipient only.

To summarize, under RCM, a registered buyer of goods/services has to pay the tax on a transaction, based on a set of rules determined by the Government.

What are these rules? We shall see next. Scenarios for RCM Eligibility

We shall now be looking into the scenarios of RCM

- First scenario occurs in case of supply of specified categories of goods or services covered by section 9(3) of CGST /SGST (UTGST) Act.

- Second scenario occurs in case of supply of specified categories of goods or services made by unregistered supplier to specified class of registered recipients covered by section 9(4) of CGST Act. However, these specified persons or specified goods have not been notified by the Government. Hence this clause is not relevant for our discussion.

- The e-commerce operator, in terms of Section 9(5): The Government is empowered to notify categories of services wherein the person responsible for payment of taxes would neither be the supplier nor the recipient of supply, but the e-commerce operator through which the supply is effected.

Applicability of Reverse Charge Mechanism on Specified Goods and Services u/s 9(3)

1. Supply of Specified Goods

| Sr no | Description of Goods | Supplier of Goods | Recipient of Supply |

| 1 | Agricultural products like

· Cashew nuts · Bidi wrapper leaves (tendu) · Tobacco leaves |

Agriculturist | Any Registered Person |

| 2 | Goods supplied by the Government like

· Lottery tickets · Used vehicles, seized and confiscated goods, old and used goods, waste and scrap |

Central Government, State Government, Union territory or a local authority | Registered Person procuring such Goods |

2. Supply of Specified Service

Illustrative list of Services covered under RCM is as follows-

| Sr.

No |

Services | Provider of service | Recipient of Service |

| 1

|

Taxable services provided or agreed to be provided by any person who is located in a non-taxable territory and received by any person located in the taxable territory | Any person who is located in a non- taxable territory | Any person located in the taxable territory |

| 2 | Services provided or agreed to be provided by a goods transport agency (GTA) who has not paid central tax @ 6% in respect of transportation of goods by road | Goods Transport Agency (GTA) | (a) any factory registered under or governed by the Factories Act, 1948.

(b) any society registered under the Societies Registration Act, 1860 or under any other law for the time being in force in any part of India. (c) any co-operative society established by or under any law. (d) any person registered under CGST/SGST/UTGST Act. (e) any body corporate established, by or under any law; or (f) any partnership firm whether registered or not under any law including association of persons. (g) Casual taxable person |

| 3 | Services provided or agreed to be provided by an individual advocate or firm of advocates by way of legal services directly or indirectly | An individual advocate or firm of advocates | Any business entity. |

| 4 | Services provided or agreed to be provided by an arbitral tribunal | An arbitral tribunal | Any business entity. |

| 5 | Sponsorship services | Any person | Anybody corporate or partnership firm. |

| 6 | Services provided or agreed to be provided by Government or local authority excluding, –

(1) renting of immovable property, and (2) services specified below- · services by the Department of Posts by way of speed post, express parcel post, life insurance, and agency services provided to a person other than Government. · those services which are in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport. · transport of goods or passengers. |

Government or local authority | Any business entity. |

| 7 | Services provided or agreed to be provided by a director of a company or a body corporate to the said company or the body corporate; | A director of a company or a body corporate | A company or a body corporate. |

| 8 | Services provided or agreed to be provided by an insurance agent to any person carrying on insurance business | An insurance agent | Any person carrying on insurance business. |

| 9 | Services provided or agreed to be provided by a recovery agent to a banking company or a financial institution or a non-banking financial company | A recovery agent | A banking company or a financial institution or a non- banking financial company. |

| 10 | Transfer or permitting the use or enjoyment of a copyright covered under clause (a) of sub-section (1) of section 13 of the Copyright Act, 1957 relating to original literary, dramatic, musical or artistic works | Author or music composer, photographer, artist, etc. | Publisher, Music company, Producer |

| 11 | Services provided by way of renting of any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration charged from the service recipient, provided to a body corporate. | Any person, other than a body corporate who supplies the service to a body corporate and does not issue an invoice charging central tax at the rate of 6 per cent. to the service recipient | Any body corporate located in the taxable territory. |

| 12 | Security services (services provided by way of supply of security personnel) provided to a registered person: Provided that nothing contained in this entry shall apply to, – (i)(a) a Department or Establishment of the Central Government or State Government or Union territory; or (b) local authority; or (c) Governmental agencies; which has taken registration under the Central Goods and Services Tax Act, 2017 (12 of 2017) only for the purpose of deducting tax under section 51 of the said Act and not for making a taxable supply of goods or services; or(ii) a registered person paying tax under section 10 of the said Act. Any person other than a body corporate. A registered person, located in the taxable territory.” | Any person other than a body corporate | A registered person, located in taxable territory |

What about Time of Supply?

In GST, Time of Supply means a point of time when goods or services are supplied. Under RCM, the time of supply shall be the earliest of the following dates:

- The date of receipt of goods

- The payment date*

- The date immediately after 30 days from the date of issue of an invoice by the supplier

If it is not possible to determine the time of supply, the time of supply shall be the date of entry in the books of account of the recipient.

*This point is no more applicable based on the Notification No. 66/2017 – Central Tax issued on 15.11.2017.

Important Points to Consider for Reverse Charge Mechanism

- Input Tax Credit: A recipient / buyer who has paid tax under RCM is eligible to avail Input Tax Credit (ITC) if she / he is able to demonstrate that the goods or services in question were used for business purposes.

- Payment of Tax: RCM has to be paid through Cash only which means Input Tax Credit cannot be utilized for payment of tax under RCM. The GST applicable under RCM must be deposited to the government on every 20th of the next month.

- Any advance payment made for the reverse charge supplies (supply of services) is also chargeable to GST. The person making the advances has to pay tax under RCM.

- Composition Scheme Dealers: – Every person registered under Composition Scheme shall discharge liability under Reverse Charge Mechanism. No credit of RCM is allowed in these cases.

- Self-invoicing: Self-invoicing is to be done when you have purchased from an unregistered supplier AND such purchase of goods or services falls under reverse charge.

That is all! RCM has become more stable by the day, and the Government has gained more clarity on the matter. For further help or assistance, feel free to contact us.