43B(h) Disallowance

Deduction for the sum payable to micro and small enterprise to be allowed on a payment basis [section 43B(h)]

The Finance Act, 2023 adds one more item to the list in section 43B, the deduction of which shall be allowed on a payment basis. It provides that any sum payable to a micro or small enterprise (“MSEs”) beyond the time limit specified in Section 15 of the Micro, Small and Medium Enterprises Development Act, 2006 (MSMED Act) shall not be allowed as a deduction.

Definition of “micro enterprises” and “small enterprises” under the MSMED Act, 2006

| Category of MSME Enterprise | Criteria for classification |

| Micro Enterprise | · Net investment in plant and machinery or equipment does not exceed Rs. 1 crore; and

· Net turnover does not exceed Rs. 5 crores. |

| Small Enterprise | · Net investment in plant and machinery or equipment does not exceed Rs. 10 crore; and

· Net turnover does not exceed Rs. 50 crores. |

| Medium Enterprise | · Net investment in plant and machinery or equipment does not exceed Rs. 50 crore; and

· Net turnover does not exceed Rs. 250 crores. |

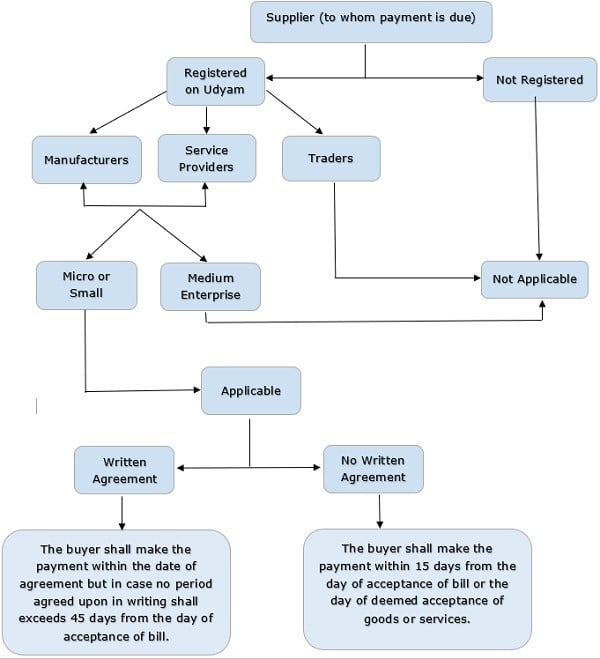

In addition to meeting the above criteria, the enterprise must be registered under Udyam Registration in order to avail of the benefits available to MSMEs. Udyam Registration is compulsory with effect from 1-7-2022. For enterprises registered before 30-6-2020, EM-Part II Registration and Udyog Aadhaar Memorandum (UAM) registration was valid only upto 30-6-2022.

Liability of buyer under MSMED Act to make timely payment to supplier

Paraphrasing section 15 of the MSMED Act, the following position emerges:

| (a) | Where any supplier (Para 5.4-4a) supplies any goods or renders any services to any buyer (Para 5.4-4b), the buyer shall make payment for the same on or before the date agreed upon between him and the supplier in writing; | |

| (b) | In no case, the period agreed upon between the supplier and the buyer in writing shall exceed forty-five days from the day of acceptance or deemed acceptance; and | |

| (c) | Where there is no agreement on this behalf, the buyer shall make payment before the appointed day (Para 5.4-4c). |

The following are the ingredients of clause (h) of section 43B:

| (a) | Any sum is payable by the asses to a micro or small enterprise[ Para 5.4-5a]; | |

| (b) | The terms “Micro Enterprise” and “Small Enterprise” shall have the meaning assigned to them in clauses (h) and (m), respectively, of section 2 of the MSMED Act [ Para 5.4-5b]; | |

| (c) | Such sum is of the nature referred to in Section 15 of the MSMED Act [ Para 5.4-5c]; | |

| (d) | The disallowance shall be made if such sum is paid beyond the time limit specified in section 15 of the MSMED Act [ Para 5.4-5d]; | |

| (e) | The deduction will be allowed only on a payment basis in the year in which the payment is made [ Para 5.4-5e]; | |

| (f) | The above provisions shall apply “Notwithstanding anything contained in any other provision of this Act” [ Para 5.4-5f]. |

Disallowance is to be made if the sum is paid beyond the time limit specified in Section 15 of the MSMED Act – The disallowance under section 43B(h) shall be made if the sum payable to the MSEs is not paid within the limitation period provided in Section 15 of the MSMED Act. Section 15 provides the following limitation period to make payments to MSEs:

| (a) | On or before the date as agreed upon in writing between the parties, which shall not exceed 45 days; | |

| (b) | Before the expiry of 15 days from the day of acceptance (or deemed acceptance) of goods or services by the buyer from the supplier, where there is no agreement. |

For example, where goods are supplied and accepted on 1-4-2023, the due date for payment under section 15 of the MSMED Act shall be computed as under:

| Date of acceptance of supply | Credit period | Due date as per Section 15 | Remarks |

| 1-4-2023 | 30 days | 30-4-2023 | Due date as per terms of the agreement |

| 1-4-2023 | 60 days | 15-5-2023 | Due date cannot exceed 45 days from the date of acceptance |

| 1-4-2023 | No agreement | 15-4-2023 | In the absence of an agreement, the due date cannot exceed 15 days from the date of acceptance |

If the payment is made on or before the due date specified in the third column, no disallowance shall be made under section 43B(h).

It should be noted that clause (h) of section 43B applies from 1-4-2024 (the assessment year 2024-25 and onwards). Any sum outstanding on 31-3-2023 and paid in the financial year 2023-24 beyond the period allowed by section 15 of the MSMED Act should not be hit by this provision. Where supply is made on or before 31-3-2023, but the buyer accepts the supply on or after 1-4-2023, the sum payable to the MSEs shall be subject to section 43B(h).

5.4-5e The deduction will be allowed only on a payment basis in the year in which the payment is made – Other clauses of section 43B allow a deduction of year-end outstanding on an accrual basis if the payment is made on or before the due date of filing the ITR. In contrast, the deduction for the sum payable to MSEs covered by clause (h) shall be deductible only if paid on or before the time allowed by section 15 of the MSMED Act. The following position emerges from the plain reading of section 43B(h) and the clarification in the Explanatory Memorandum:

| (a) | Sum already paid during the year but beyond the limitation period of section 15 shall be allowed on payment basis in the year in which it is paid. | |

| (b) | Where the amount outstanding at the year-end is paid in the next year within the time limit stipulated by section 15 of MSMED Act, the deduction will be allowed in the current year on an accrual basis. | |

| (c) | Where the due date for the payment of the amount outstanding at year-end has exceeded the limitation period of section 15 of the MSMED Act, such amount shall be disallowed while computing the business income; | |

| (d) | Where the amount outstanding at year-end is paid next year but beyond the limitation period of section 15 of the MSMED Act, such amount shall be allowed while computing the business income in the next year on an actual payment basis. |