All about E-Invoicing

What is e-invoicing?

Businesses already registered for GST must generate e-invoices for B2B transactions. The e-invoice turnover limit is Rs. 10 Cr. which came into effect on 1st October 2022 according to irisgst.com. At first, e-Invoicing was only for large enterprises but later on, small and mid-sized businesses are also included. E-invoices can be recognized using a unique IRN. Details about IRN are stated below.

What is IRN?

Denoted by Invoice Reference Number. It is a 64-character hash number. The Invoice Registration Portal (IRP) validates the IRN and generates a QR code. IRN is quantified using a hash algorithm. The IRN will be unique for each e-invoice in a financial year by a GST Identification Number. The invoice is then signed and sent to the supplier. The tax officers can track the details in offline mode with the help of an application. The app is Tally.ERP 9.If an e-invoice is to be canceled, the IRN has to be informed within 24 hours.

Generation of IRN

There are two options for the generation of IRN for the taxpayer:

| The IP address could be whitelisted on the e-invoice portal of the computer system.

This can be done for integration via GSP i.e. GST Suvidha Provider |

The invoices need to be bulk uploaded through bulk generation.

A JSON file will be generated that will uploaded for the generation of IRNs in bulk amount to the e-invoice portal. |

IRN must be requested first.

IRN can be requested with the following steps:

- Visit the e-invoice portal.

- Click on Help.

- Go to Tools.

- Go to Bulk Generation tools.

- After the request has been prepared, it has to be then uploaded to generate the IRNs.

- It can be downloaded after generation.

4 main parameters of on IRN:

- GST Identification Number of Supplier.

- Invoice number (given by Supplier).

- Date of generation of Invoice.

- Document type.

Digital signature for e-invoice

It is mandatory to have a software that will be able to read the digital signature.

Make sure the ‘emSigner’ toll is installed.

Follow the steps:

Step 1:

Invoice can be generated in various JSON formats like offline utilities, etc. Now, log in to the IRP. Attach the JSON.

Step 2:

Click on the ‘Verify using DSC’ (Digital Signature Certificate). Various digital signatures will be displayed in the dialogue box.

Step 3:

After selecting the required digital signature, click the ‘Sign’. You may need to enter the password for the DSC.

Step 4:

A message will open stating the attachment of the DSC.

Step 5:

Press OK.

Applicability of e-invoice:

| Phase | Applicable to taxpayers having an aggregate turnover of more than | Applicable date |

| 1 | Rs 500 crore | 01.10.2020 |

| 2 | Rs 100 crore | 01.01.2021 |

| 3 | Rs 50 crore | 01.04.2021 |

| 4 | Rs 20 crore | 01.04.2022 |

| 5 | Rs 10 crore | 01.10.2022 |

| 6 | Rs. 5 crore | 01.08.2023 |

Required fields of e-invoice:

E-invoicing must follow the GST invoicing rules, invoicing system rules, policies of each industry or sector in India. Some details are mandatory whereas some are not for businesses. Below list of contents is notified on 30th July 2020 via Notification No.60/2020 – Central Tax.

- 12 sections (mandatory + optional) and six annexures which consist of a total of 138 fields.

- Out of the 12 sections, five are mandatory, and seven are optional. Two annexures are mandatory.

- The five mandatory sections are basic details, supplier information, recipient information, invoice item details, and document total. The two mandatory annexures are details of the items and the document total.

List of mandatory fields to be declared in an e-invoice:

| Sr. no. | Name of the field | List of choices/details/sample inputs | Remarks |

| 1 | Document Type Code | Enumerated List such as INV/CRN/DBN. | The type of document must be specified here. |

| 2 | Supplier_Legal Name | String Max length: 100 | Legal name of the supplier must be as per the PAN card |

| 3 | Supplier_GSTIN | Max length: 15 Must be alphanumeric. | GSTIN of the supplier raising the e-invoice. |

| 4 | Supplier_Address | Max length: 100. | Building/Flat no., Road/Street, Locality, etc. of the supplier raising the e-invoice. |

| 5 | Supplier_Place | Max length: 50. | Supplier’s location such as city/town/village must be mentioned. |

| 6 | Supplier_State_Code | Enumerated list of states. | The state must be selected from the latest list given by GSTN. |

| 7 | Supplier Pincode | Six digit code. | The place (locality/district/state) of the supplier’s locality. |

| 8 | Document Number | Max length: 16 Sample can be “ Sa/1/2019”. | For unique identification of the invoice, a sequential number is required within the business context, time frame, operating systems and records of the supplier. No identification scheme is to be used. |

| 9 | Preceeding_Invoice_Reference and date | Max length:16 Sample input is “ Sa/1/2019” and “16/11/2020”. | Detail of original invoice which is being amended by a subsequent document such as a debit and credit note. It is required to keep future expansion of e-versions of credit notes, debit notes and other documents required under GST. |

| 10 | Document Date | String (DD/MM/YYYY) as per the technical field specification. | The date when the invoice was issued. However, the format under explanatory notes refers to ‘YYYY-MM-DD’. Further clarity will be required. Document period start and end date must also be specified if selected. |

| 11 | Recipient_ Legal Name | Max length: 100. | The name of the buyer as per the PAN. |

| 12 | Recipient’s GSTIN | Max length: 15. | The GSTIN of the buyer to be declared here. |

| 13 | Recipient’s Address | Max length: 100. | Building/flat no., road/street, locality, etc. of the supplier raising the e-invoice. |

| 14 | Recipient’s State Code | Enumerated list. | The place of supply state code to be selected here. |

| 15 | Place_Of_Supply_State_ Code | Enumerated list of states. | The state must be selected from the latest list given by GSTN. |

| 16 | Pincode | Six digit code. | The place (locality/district/state) of the buyer on whom the invoice is raised/ billed to must be declared here if any. |

| 17 | Recipient Place | Max length: 100. | Recipient’s location (City/Town/Village). |

| 18 | IRN- Invoice Reference Number | Max length: 64 Sample is ‘a5c12dca8 0e7433217…ba4013 750f2046f229’. | At the time of the registration request, this field is left empty by the supplier. Later on, a unique number will be generated by GSTN after uploading the e-invoice on the GSTN portal. An acknowledgement will be sent back to the supplier after the successful acceptance of the e-invoice by the portal. IRN should then be displayed on the e-invoice before use. |

| 19 | ShippingTo_GSTIN | Max length: 15. | GSTIN of the buyer himself or the person to whom the particular item is being delivered to. |

| 20 | Shipping To_State, Pincode and State code | Max length: 100 for state, 6 digit pincode and enumerated list for code. | State pertaining to the place to which the goods and services invoiced were or are delivered. |

| 21 | Dispatch From_ Name, Address, Place and Pincode | Max length: 100 each and 6 digit for pincode. | Entity’s details (name, and city/town/village) from where goods are dispatched. |

| 22 | Is_Service | String (Length: 1) by selecting Y/N. | Whether or not supply of service must be mentioned. |

| 23 | Supply Type Code | Enumerated list of codes Sample values can be either of B2B/B2C/ SEZWP/S EZWOP/E XP WP/EXP WOP/DE XP. | Code will be used to identify types of supply such as business to business, business to consumer, supply to SEZ/exports with or without payment, and deemed export. |

| 24 | Item Description | Max length: 300 The sample value is ‘Mobile’ The schema document refers to this as the ‘identification scheme identifier of the Item classification identifier’. | Simply put, the relevant description is generally used for the item in the trade. However, more clarity is needed on how it needs to be described for every two or more items belonging to the same HSN code. |

| 25 | HSN Code | Max length: 8. | The applicable HSN code for particular goods/service must be entered. |

| 26 | Item_Price | Decimal (12,3) Sample value is ‘50’. | The unit price, exclusive of GST, before subtracting item price discount, can not be negative. |

| 27 | Assessable Value | Decimal (13,2) Sample value is ‘5000’. | The price of an item, exclusive of GST, after subtracting the item price discount. Hence, gross price (-) discount = net price item, if any cash discount is provided at the time of sale. |

| 28 | GST Rate | Decimal (3,2) Sample value is ‘5’. | The GST rate represented as a percentage that is applicable to the item being invoiced. |

| 29 | IGST Value, CGST Value and SGST Value Separately | Decimal (11,2) Sample value is ‘650.00’. | For each individual item, IGST, CGST and SGST amounts have to be specified. |

| 30 | Total Invoice Value | Decimal (11,2). | The total amount of the Invoice with GST. Must be rounded to a maximum of 2 decimals. |

Conditions for e-invoicing:

Earlier, the invoices needed to be manually uploaded in the GSTR-1. GSTR-1 is a return that states all the outward supplies of a taxpayer. The invoice information now gets reflected into the GSTR-2B for the recipients. The transporters had to manually generate bills by importing in the Excel or JSON manually or via ERP. The generation and uploading of the invoice details is done using the Excel toll or JSON or via any integration.

Creating the invoice:

Invoice is generated using an accounting or billing software.

Note: It is not compulsory for any taxpayer to generate the e-invoice using the government tax portal. Still, the taxpayer must keep this in mind that the invoice should be generated in the given e-invoicing format.

- Creating the Invoice Registration Number:

Details are given in the ‘Generation of IRN’.

- Invoice Registration Portal: IRN along with JSON file for each of the B2B invoice is uploaded on the IRP.

- IRP validation: IRP validates the generated hash which is attached with JSON or generates an IRN

- Note: IRN is unique for whole financial year.

- Creation of QR code and digital signature: The QR code is attached to the JSON file.IRP digital sign is updated on the invoice data.

- E-invoice, e-way bill and GST system: The E-way and GST system is updated with the uploaded data.This data will be further used for the auto-population of GST Annextures.

- E-invoice receipt: A digitally signed JSON is sent by the portal with the IRN and QR code to the seller. Invoice is also sent to the buyer on registered email id.

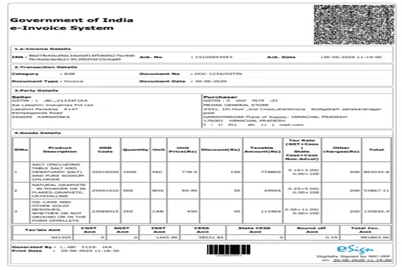

E-invoice format

Documents in E-invoicing

Following documents compromise e-invoicing applicability:

- Tax invoices.

- Credit notes.

- Debit notes under Section 34 of the CGST Act.

Transactions in E-invoicing:

- Taxable Business-to-Business sale of goods or services.

- Business-to-government sale of goods or services.

- Exports.

- Deemed exports.

- Supplies to Special Economic Zone(SEZ) with or without tax payment.

- Stock transfers or supply of services to distinct persons.

- SEZ developers.

- Supplies under reverse charge covered by Section 9(3) of the CGST Act.

Importance of E-Invoice to businesses:

Systematic processes save turnaround time:

Business owners can easily take benefit of the e-invoicing with no need to duplicate the content as it is easily sync able, easily accessible and aggregates information between many devices at once. E-invoice helps in streamlining the processes thus reducing the wastage of time and human errors. Optimization leads in increased productivity of the businesses.

Better limpidity and clarity:

E-invoicing improves clarity into purchase orders, contracts, documentation, etc. It tracks and serves audit trails which helps in step-by-step verification in the business transactions. The functionalities are available through mobile e-invoice apps.

Green initiative:

The use of paper-base is reduced. Both, the wastage of natural things like paper and cost are avoided.

Rapid availability of the input tax credit.

- Time used in the surveys is saved as the details are available at a transaction level.

- Efficient access to invoice discounting and financing for small and new businesses.

- Improvement in relation between client and customer of small businesses to tie up with large scale businesses.

To whom is e-invoicing mandatory?

E-invoicing is mandatory for the GST registered persons whose aggregate turnover in previous financial years from 2017-18 to 2021-22 exceeds Rs.20 crore. E-invoicing applies to those with a turnover of more than Rs.10 crore up to Rs.20 crore from 1st October 2022.

Who is allowed not to use e-invoice?

Businesses:

- An insurer or a banking company or a financial institution, including an NBFC.

- A Goods Transport Agency (GTA).

- A registered person supplying passenger transportation services.

- A registered person supplying services by way of admission to the exhibition of cinematographic films in multiplex services.

- An SEZ unit (excluded via CBIC Notification No. 61/2020 – Central Tax).

- A government department and Local authority (excluded via CBIC Notification No. 23/2021 – Central Tax).

- Persons registered in terms of Rule 14 of CGST Rules (OIDAR).

Documents:

- Delivery challans.

- Bill of supply.

- Financial or commercial credit note or debit note.

- Bill of entry.

- ISD invoices.

Transactions:

- Any Business-to-Consumers (B2C) sales.

- Nil-rated or non-taxable or exempt B2B sale of goods or services.

- Nil-rated or non-taxable or exempt B2G sale of goods or services.

- High sea sales and bonded warehouse sales.

- Free Trade & Warehousing Zones (FTWZ).

- Supplies under reverse charge covered by Section 9(4) of the CGST Act.

Relation between tax evasion and e-invoice:

- The generation of all invoices is from the GST portal. So, fake GST invoices are avoided and only genuine input credit is claimed. Fake tax credits are easily identified as the input credit is matched with the output tax details.

- Controlling invoices is avoided as the generation of the e-invoice is carried out before a transaction is carried out.

- The tax authority can access the e-invoice transactions as the e-invoice is generated through the GST portal.

Latest Updates:

30th January 2023

Few updates are made on the NIC’s e-invoice portal

- User can select POS state code of ’96-Other Country’ against items where HSN codes are 9965 and 9968 (Services by way of transportation of goods, including by mail or courier).

- The documents dated 1/10/2021 or after shall only be considered on the portal.

- The portal has added a new error code 2295 for duplicate requests apart from 2150, with error as ‘IRN is already generated and registered with GSTN Lookup Portal by other IRP’.

11th October 2022

The GST Council may implement the next phase of e-invoicing for businesses with an annual turnover of more than Rs.5 crore from 1st January 2023. The system may get extended to businesses with a turnover of over Rs.1 crore by the end of the next fiscal year.

1st August 2022

The e-Invoicing system for B2B transactions has now been extended to those with an annual aggregate turnover of more than Rs.10 crore up to Rs.20 crore starting from 1st October 2022, vide notification no. 17/2022.

24th February 2022

The e-Invoicing system will get extended for those whose annual aggregate turnover is more than Rs.20 crore up to Rs.50 crore starting from 1st April 2022, vide notification no. 1/2022.

For more details, write to us.