PMT-09: Importance and Usage

Introduction

CBIC has recently introduced new facility to shift wrongly paid tax, interest and late fees using form PMT-09. In today’ blog we are going to discuss about intricacies of PMT-09 in the electronic cash ledger. But first we will have brief understanding about electronic cash ledger.

Electronic Cash Ledger

Electronic cash ledger is a cash ledger that contains deposits that a taxpayer has made any GST payments made through cash.

Each of the major heads –CGST, SGST, IGST are further divided into 5 minor heads. Tax, Interest, Penalty, Fees and Others.

The electronic cash ledger is maintained on GST portal. The mode of payment in electronic cash ledger is –net banking, NEFT, RTGS, or over the counter. The electronic cash ledger is the summary of cash available to pay off GST liability.

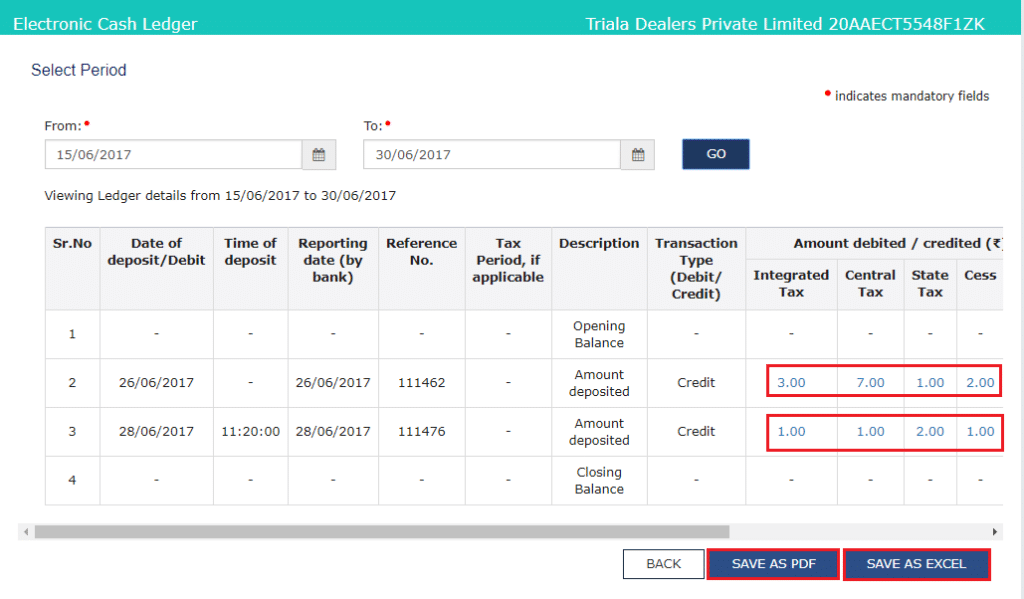

Electronic cash ledger will display following details-

New facility in the form of PMT-09

Usage of PMT-09

Various taxpayers at the time of making GST challan payment have done mistakes by filling the amounts in wrong head. For instance, the taxpayer who wanted to pay the amount in CGST and SGST have wrongly paid tax under IGST head or vice versa.

Once the taxpayer pays the challan the payment gets credited in that head and can be utilized in settling their relevant output liabilities after adjusting the Input Tax credit. However, where the challan is paid in the wrong head it cannot be used for discharging the liabilities of that head due to which the taxpayers need to file another challan.

There were two options for amount wrongly paid-

Amount wrongly paid can remain in cash ledger and can be utilized for discharging tax liability in future or,

To claim refund of the amount wrongly paid by filing a refund application in Form RFD-01 choosing the option viz Refund of excess balance in cash ledger. However, refund process would certainly take 3-4 months and would involve additional paperwork. Both the options would result into blockage of working capital for taxpayers.

In order to remove this difficulty, recently the CBIC introduced Form PMT-09 for shifting of tax paid under wrong heads. This enables a taxpayer to transfer amount of tax, interest, penalty that is available in electronic cash ledger to the appropriate tax or cess head under IGST, CGST, and SGST. Hence, if a taxpayer has wrongly paid IGST instead of CGST and SGST; he can now easily rectify the same using Form PMT -09 by reallocating the amount from IGST tax head to CGST and SGST tax head.

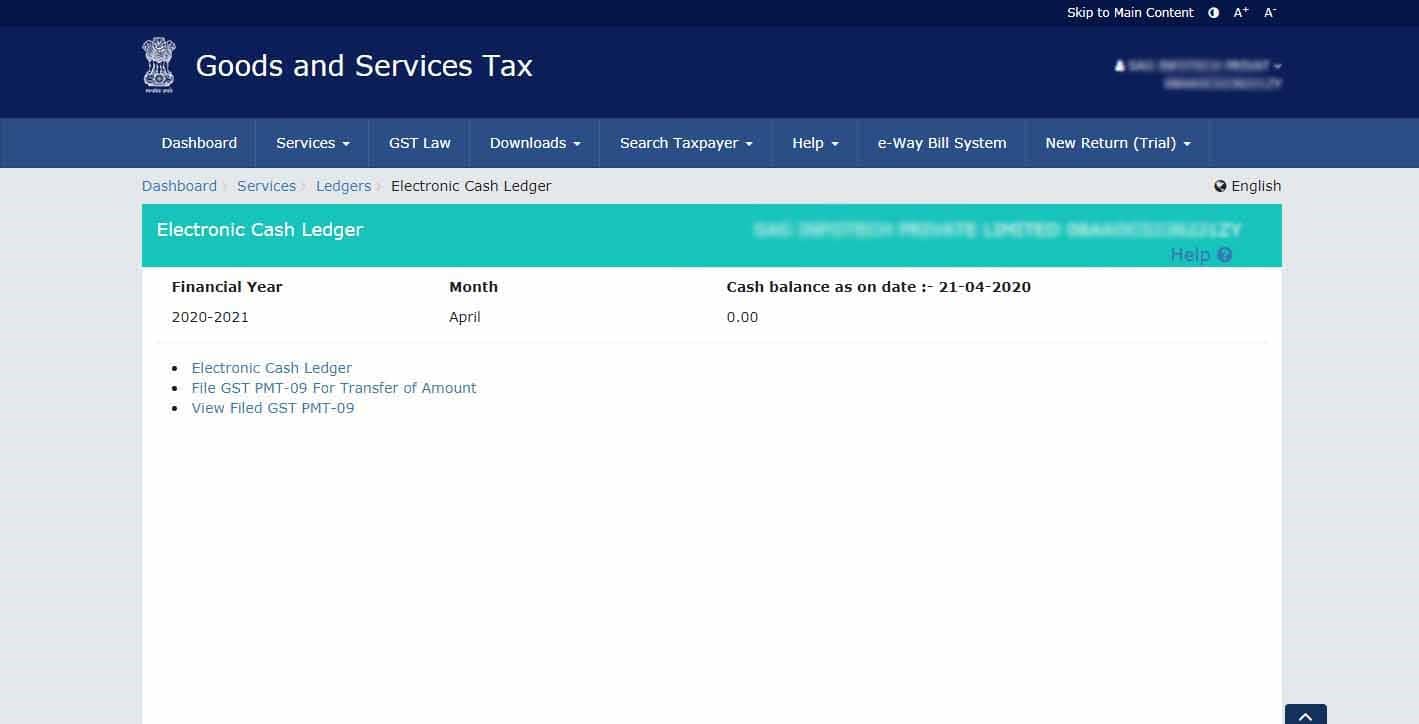

The facility to use PMT-09 was made LIVE on the GST Portal on 21 April 2020. The option is available after the taxpayer logs in, under the electronic cash ledger tab. Thus, a taxpayer can now easily rectify wrongly paid taxes or other amounts.

Format of PMT-09:

PMT 09 consists of Major heads and Minor heads. Major head refers to IGST,SGST,SGST and Cess. Whereas Minor head refers to Tax, interest, penalty and late fees.

The form may be filled up if amount from one major / minor head is intended to be transferred to another major/minor head.

The amount from one minor head can also be transferred to another minor head under the same major head.

Filing Procedure of PMT-09

After login into GST portal, click on Services> Ledgers>Electronic Cash Ledger

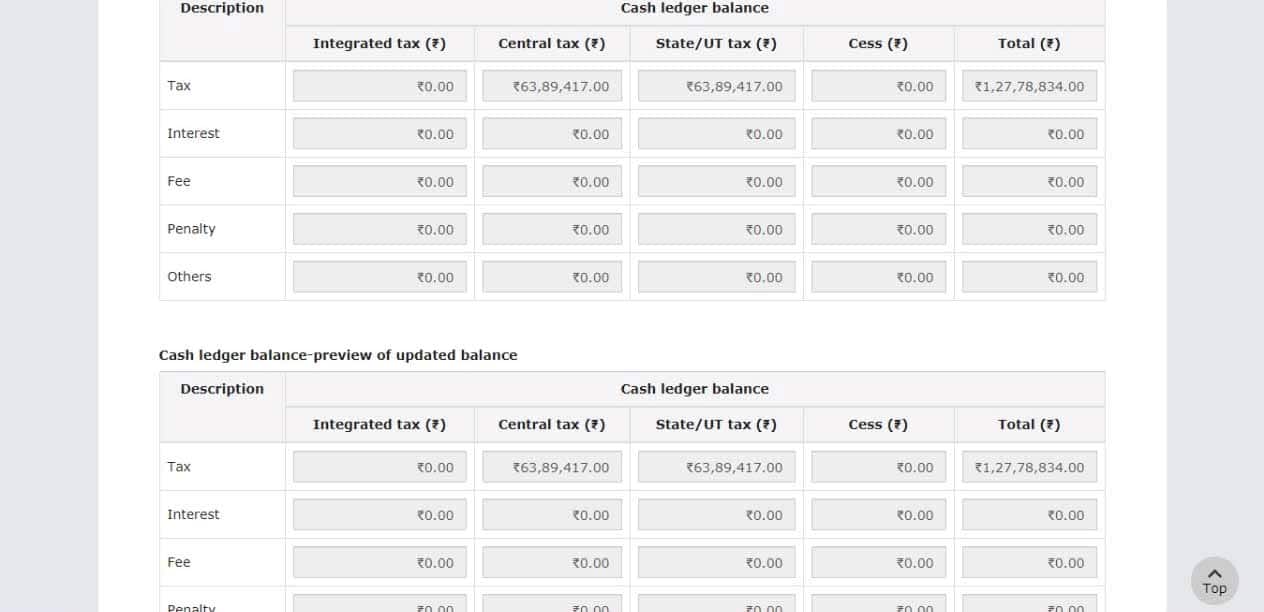

Click on File GST PMT-09 for Transfer of Amount, then following window will be displayed

Cash ledger balance-available for transfer : In this table, we will able to view the balance available in an electronic cash ledger.

> Cash ledger balance-preview of updated balance : In this table, we will able to view the updated balance of cash ledger after updating the details as per the requirement (Under Major head / Minor head).

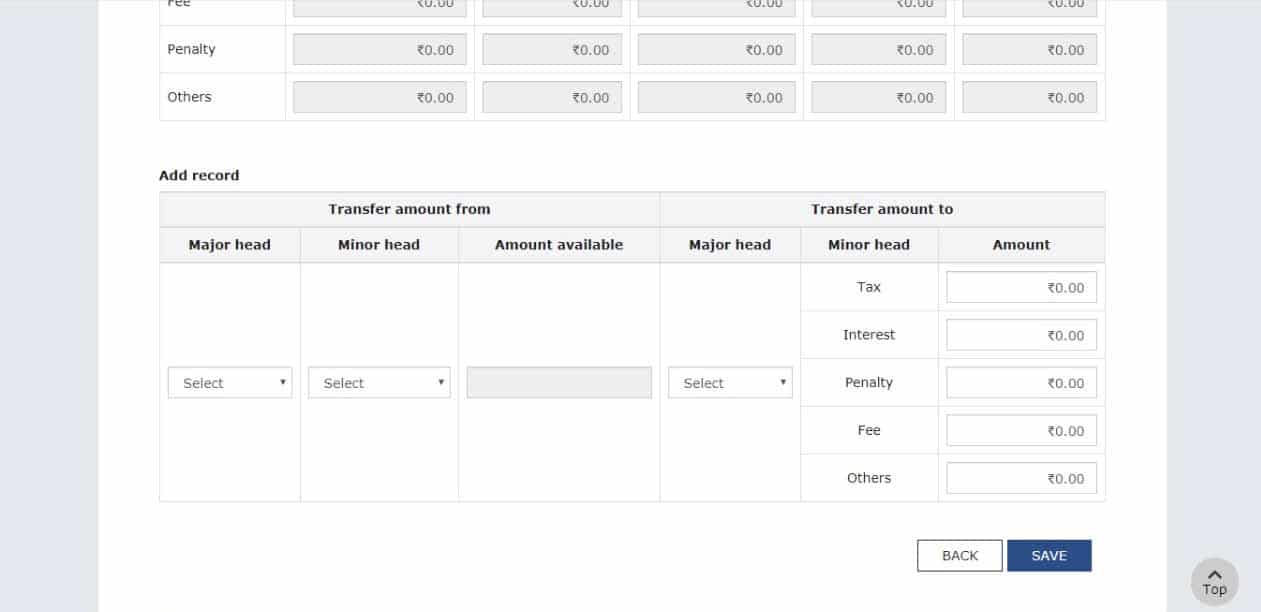

> Add record : In these table, we will enter the details in “Transfer amount from” and “Transfer amount to” column as per the requirement

2.3.3. You can file “GST PMT 09” with OTP and ARN will be shared on your registered email id on successful filing. After successful filing of PMT 09, you will be able to view updated Cash ledger

Key points to note

If wrong tax has already been utilized for making any payment then this form is not useful. This Form only allows transfer of the amount that are available in the electronic cash ledger. It will be able to handle only one situation and that is when payment is done in the wrong head and not utilized.

The amount once utilized and removed from cash ledger cannot be reallocated

GST PMT 09 is not a solution for revision in GSTR 3B, GSTR 3B once filed can not be revised.